Market Changes

When Markets Are Down, What Should You Do About RMDS?

Keep these strategies and considerations in mind. To ensure that tax liabilities aren’t deferred indefinitely, investors are obligated by the IRS to take required minimum distributions (RMDs) from most retirement accounts. For those born after June 30, 1949, RMDs begin at age 72; for those born earlier, RMDs begin at age 70½. Volatile markets…

Read MoreJanuary Market Recap

First Quarter 2021 Market Update and a Close Look at Inflation

First Quarter Market Update The first quarter of 2021 witnessed a boost for the economy as the continued expansion of the vaccine rollout and the passage of the almost $2 trillion stimulus bill was reflected in rising gross domestic product (GDP) estimates, a further move up in equity prices, and a steady rise in interest…

Read MoreDoes the President Impact Your Long-Term Investments?

There’s an old adage on Wall Street known as “Climbing the Wall of Worry.” There’s plenty to worry about this year, indeed. We’ve had many questions recently about the 2020 Presidential Election and its effect on financial plans. So what does it mean for your long-term investments? Election time concerns are sensible, since campaigns are…

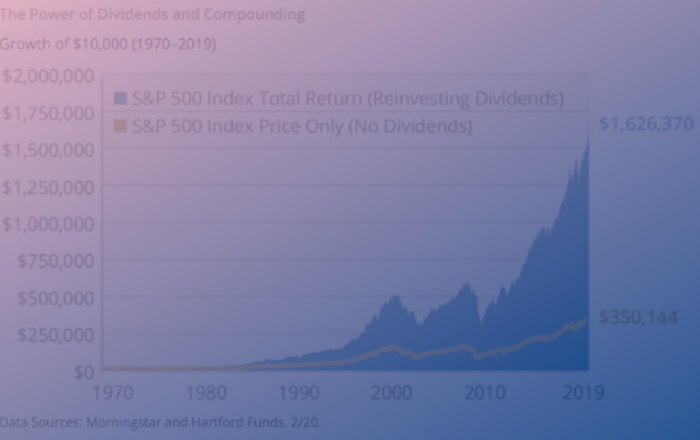

Read More5 Ways to Get the Power of Dividends to Work for You

Everyone likes to get paid. Did you know that you can get paid as an investor, too? How? Through the power of dividends. When a company earns a profit, there are two main places where the money can go: The profits can be put back into the company to expand operations (by purchasing additional equipment)…

Read MoreGiving in the Time of a Volatile Market

During times of market volatility, it’s important to review charitable options and opportunities. The coronavirus has financially impacted individuals and businesses, and market volatility may leave you cautious about making gifts. Temporary provisions in the CARES Act can promote charitable giving as well as provide you with other gifting opportunities. Because so many of you…

Read More3 Types of Bear Markets (And Why It’s Important To Know The Difference)

Turn on the morning news or read an article anytime we are experiencing market fluctuations or significant economic events, and you will likely hear those in finance discuss whether they believe we are experiencing a ‘bull’ or a ‘bear’ market. What are bull or bear markets? These are terms used to describe longer-term economic and…

Read MoreCurrent Market Conditions and the Coronavirus

People are asking ‘What should I be doing with my portfolio.” Listen as Sherry shares her advice.

Read MoreVolatile Times: The Impact of the Coronavirus on the Market

As concerns mount against the spread of the Coronavirus (COVID-19) to the United States, we have many clients getting in touch with questions and concerns surrounding the recent market activity. In light of this, we wanted to compile some further information for sharing with you. What is COVID-19? According to CDC.gov, “Coronaviruses are a…

Read More6 Key Changes to Know Brought by the SECURE Act

If you’ve kept your eyes or ears on the news, it’s likely that you’ve heard the SECURE Act referenced in some form. The SECURE Act is a piece of legislation that was passed in December of 2019. SECURE is an acronym that stands for ‘Setting Every Community Up for Retirement Enhancement’. There are many…

Read More