Investing

The pledged-securities mortgage explained

Most buyers in the market for a home can expect to need a 20% downpayment, which represents a significant amount of money in today’s real estate market. But even if they have the funds in their bank or investment accounts, they may not want to use them – and they may not have to if…

Read MoreDon’t let estate blunders get in the way of your wishes

ESTATE & GIVING These cautionary tales of estate planning mistakes offer a few important lessons. You’ve worked long and hard to build your estate. Don’t let blunders keep your wishes from being carried out and leave your family – and wealth – in the lurch. Here are a few lessons to keep in mind. No…

Read MoreThe Wealth Transfer: A Fusion of Financial Literacy and Family Values

Wealth transfer is a multifaceted journey that extends beyond numbers and assets – it embodies the essence of family values and the preservation of legacy. In a world where affluent individuals seek to impart financial wisdom to the next generation, the fusion of financial literacy and family values takes center stage. Explore how the intersection…

Read MoreGifting in a Volatile Market

REVIEW YOUR CHARITABLE OPTIONS AND OPPORTUNITIES. Economic turbulence and high inflation may have you feeling cautious about making donations. The good news is there’s a range of options to ensure that your charitable donations aren’t forced to grind to a halt, and that causes important to you continue to receive support. Explore some of the…

Read MorePlanning for Retirement – All About IRA’s

What is an IRA? An individual retirement account (IRA) is a personal retirement savings plan that offers specific tax benefits. In fact, IRAs are one of the most powerful retirement savings tools available to you. Even if you’re contributing to a 401(k) or another plan at work, you might also consider investing in an IRA.…

Read MoreWhat Savvy Investors Know About Social Security

Retirement and Longevity Explore some of the ways that well-informed retirees make the most of their Social Security benefits. In any financially independent retirement, Social Security benefits are bound to play a significant role. Not many reliable sources of income bring as much to the table regarding cash flow and cost-of-living increases just about every…

Read MoreFirst Quarter 2021 Market Update and a Close Look at Inflation

First Quarter Market Update The first quarter of 2021 witnessed a boost for the economy as the continued expansion of the vaccine rollout and the passage of the almost $2 trillion stimulus bill was reflected in rising gross domestic product (GDP) estimates, a further move up in equity prices, and a steady rise in interest…

Read MoreWomen Investors: Planning for More

No Matter Where You Are or Where You’re Going Successful businesswoman, entrepreneur, artist, mother, wife, mentor, leader, community activist: Whether for your education, career, or family, you probably had a plan to help you reach your goals. And as a woman, you have likely faced unique financial challenges, challenges that make proactive planning and investing…

Read MoreSee How We Give the Information You Need – When You Need It

In addition to a carefully constructed long-term financial plan, working with Gratz Park Private Wealth gives you ready access to vital information. Whether it’s logging in to Client Access to track all of your accounts in one secure place or reviewing important investment disclosures, you can get the information you need – when you need…

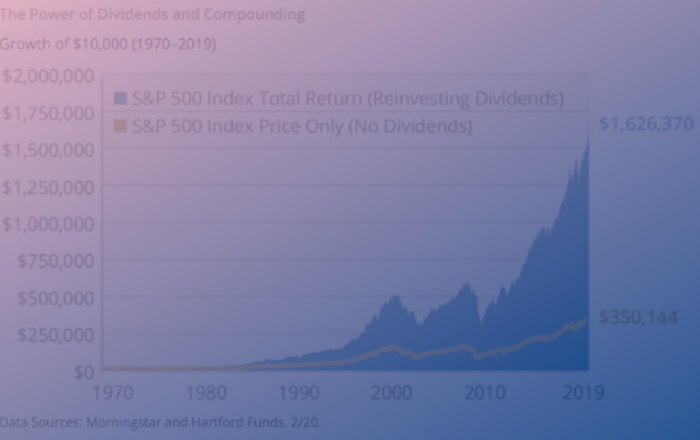

Read More5 Ways to Get the Power of Dividends to Work for You

Everyone likes to get paid. Did you know that you can get paid as an investor, too? How? Through the power of dividends. When a company earns a profit, there are two main places where the money can go: The profits can be put back into the company to expand operations (by purchasing additional equipment)…

Read More