Does the President Impact Your Long-Term Investments?

There’s an old adage on Wall Street known as “Climbing the Wall of Worry.” There’s plenty to worry about this year, indeed. We’ve had many questions recently about the 2020 Presidential Election and its effect on financial plans. So what does it mean for your long-term investments?

Election time concerns are sensible, since campaigns are naturally super-charged with emotional speeches, endorsements, and pleas—plus the voters’ hopes, wants and dreams that go with them.

Presidential elections stir up the national conversation about anything and everything, from the economy and immigration to taxes and healthcare. The swarming, ever-present media coverage leading up to the election breeds a lot of negativity and uncertainty. And for investors, that’s a double-dose of worry.

Investors tend to view the outcome of an election as “good” or “bad” for their investments. If their candidate wins, their investments win, and vice versa. How accurate is that perspective? How have elections impacted investment portfolios in the past?

Sherry Holley of Gratz Park Private Wealth said around election time, “Avoid that leap to change investments” because of the expected election outcome. An election is just one of many factors that influence investments.

Distractions and worry about the results of an election are typically unfounded. Historically, the stock market has performed about the same, whoever sits in the White House. Look at the following examples and the chart below.

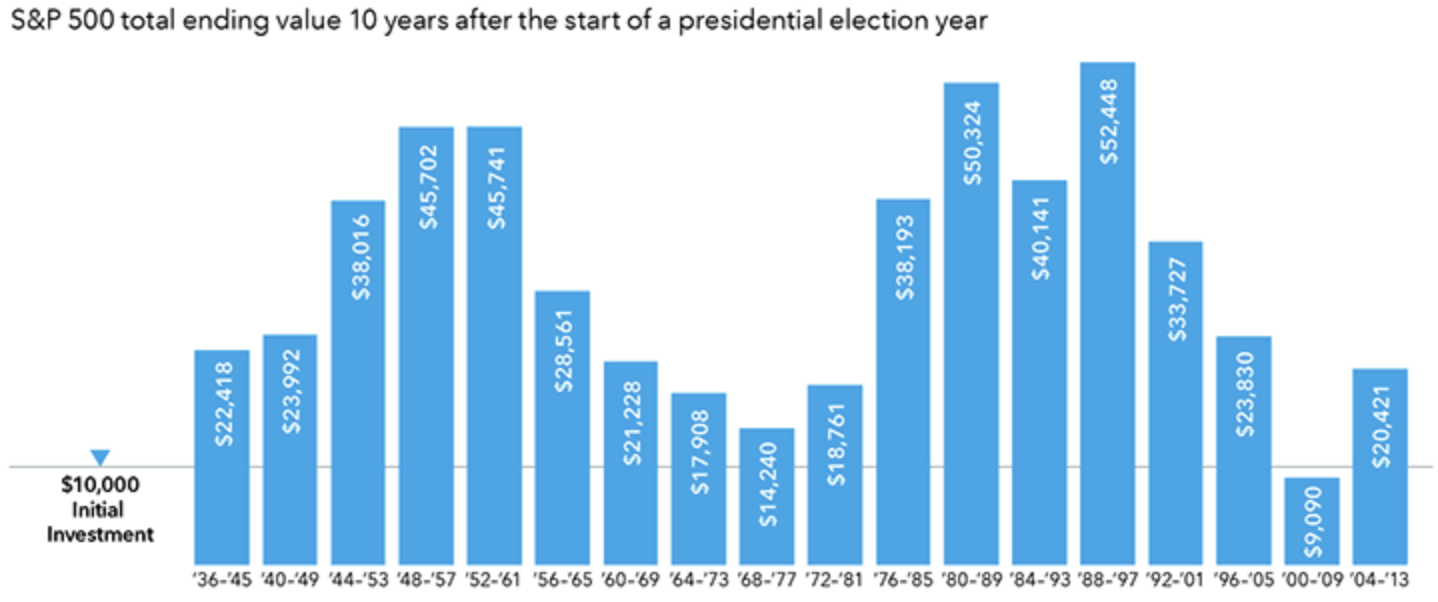

Growth of a Hypothetical $10,000 Investment Made at the Beginning of an Election Year

Source: Thomson InvestmentView

The chart shows decades from January 1 of the election year to December 31, ten years later. For example, the 1984 election of Ronald Reagan illustrates a period from election-year January 1, 1984, to December 31, 1993, ten years after the election. For example, a hypothetical $10,000 in the Standard and Poor’s 500 Index on January 1, 1984, would grow to $40,141 ten years later on December 31, 1993.

Let’s consider a hypothetical investment of $10,000 the Standard and Poors 500 Index made at the beginning of each election year going back eight decades to 1936. In 17 of the last 18 time periods covering the election year and ten years later, the investment would have gained value, regardless of the political party of the President. The message is that the party occupying the White House is less significant to an investor than the principle of focusing on a well-planned, long-term investment strategy.

Consider another scenario: The 1936 presidential election occurred in the midst of the Great Depression with high unemployment, low profits, and a poor economic outlook. A $10,000 investment made in the 1936 election year of Democrat Franklin D. Roosevelt would have returned $22,418 a decade later in 1945.

In 1968, Republican Richard Nixon won the White House, and in the next decade, the events would include a recession, war in the Middle East, oil prices jumping fourfold, and the Watergate scandal. A hypothetical $10,000 investment in the S&P 500 in 1968 would grow to $14,240 by year-end 1977.

The highest 10-year return in the chart is the period of Republican George H.W. Bush’s White House win. A $10,000 hypothetical investment in the S&P 500 in 1988 would have grown to $52,448 a decade following the election in 1997. Not all of the election periods returned positive results. There was a single negative period from 2000 to 2009. That period experienced the bursting of the dot-com bubble, the tragedy of 9/11, a global war on terror, and the 2008 economic meltdown.

Historically, economic data and earnings have driven long-term stock market returns, not the occupant of 1600 Pennsylvania Avenue. Focusing on the pre-election hysteria and who wins the election is not a productive long-term investment strategy.

The question for an investor around election time is not “What can we do right now to set up for a win/loss of [insert candidate name here]. A more productive approach is, “Let’s make sure I’m on track to meet my goals—regardless of who’s in the White House.”

As always, please reach out to our team with any questions you may have. And, thank you for your trust in us.