Second Quarter GDP Report Reflects Early Pandemic Response

The U.S. economy contracted 9.5% through the second quarter, the worst single-quarter decline in gross domestic product (GDP) since the Commerce Department started tracking it in 1947. It was expected the report would show a dip, but it’s important to recognize what that dip represents. It does not attest to the economy’s current trajectory, just…

Read MoreThe Top 7 Social Security Myths (and How To Get the Most from Your Hard-Earned Benefits)

“Social Security is not a one size fits all decision. Health, lifestyle, and family considerations all play a role,” says Shannon Seltsam, Wealth Associate, Gratz Park Private Wealth. Your team of advisors at Gratz Park Private Wealth advocate that within your retirement income plan, Social Security retirement benefits should be considered a critical asset, alongside…

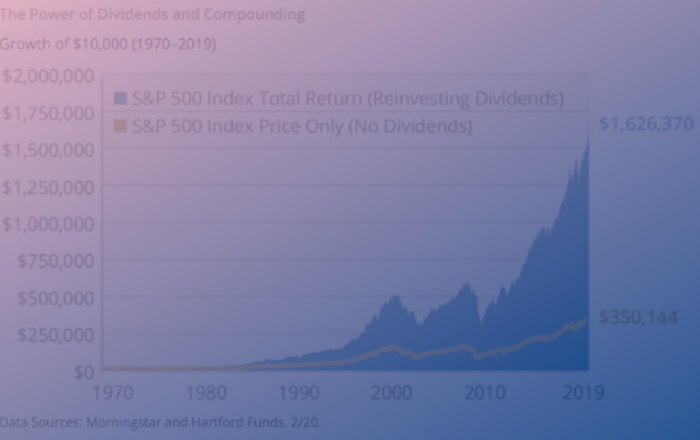

Read More5 Ways to Get the Power of Dividends to Work for You

Everyone likes to get paid. Did you know that you can get paid as an investor, too? How? Through the power of dividends. When a company earns a profit, there are two main places where the money can go: The profits can be put back into the company to expand operations (by purchasing additional equipment)…

Read MoreMixed Results in June; Tech Stocks Continue to Outperform

The equity market hit a year-to-date high in June but was tempered by emerging coronavirus cases as states slackened their isolation orders, ending with a near flat month after three months of sustained rebound from the March 23 low. The COVID-19 pandemic continues to drive fiscal and monetary policy, and as Federal Reserve Chairman Jerome…

Read MoreGiving in the Time of a Volatile Market

During times of market volatility, it’s important to review charitable options and opportunities. The coronavirus has financially impacted individuals and businesses, and market volatility may leave you cautious about making gifts. Temporary provisions in the CARES Act can promote charitable giving as well as provide you with other gifting opportunities. Because so many of you…

Read More3 Types of Bear Markets (And Why It’s Important To Know The Difference)

Turn on the morning news or read an article anytime we are experiencing market fluctuations or significant economic events, and you will likely hear those in finance discuss whether they believe we are experiencing a ‘bull’ or a ‘bear’ market. What are bull or bear markets? These are terms used to describe longer-term economic and…

Read MoreThe CARES Act Passed Into Law

The CARES Act Passed Into Law From rebate checks to small business support, there’s a lot packed into the Coronavirus Aid, Relief, and Economic Security (CARES) Act that was signed into law on Friday. The $2+ trillion emergency fiscal stimulus package is intended to mitigate some of the economic effects of dealing with COVID-19. Here’s…

Read MoreVolatility Continues as Fiscal Stimulus Package Takes Shape

Market Volatility Tip: If you had invested in the stock market from 1999-2018, and not touched it, your money would have nearly tripled. But if you had traded in and out and missed out on just the 10 best-performing stock market days over that 20 year period—your returns would have only been half of that.…

Read MoreCurrent Market Conditions and the Coronavirus

People are asking ‘What should I be doing with my portfolio.” Listen as Sherry shares her advice.

Read MoreVolatile Times: The Impact of the Coronavirus on the Market

As concerns mount against the spread of the Coronavirus (COVID-19) to the United States, we have many clients getting in touch with questions and concerns surrounding the recent market activity. In light of this, we wanted to compile some further information for sharing with you. What is COVID-19? According to CDC.gov, “Coronaviruses are a…

Read More