Deadline Reminder: Contribute to IRAs by April 18th

Even though tax filing season is well under way, there is still time to make a contribution for 2021 to a Traditional or Roth IRA until Monday, April 18th, 2022. You can contribute up to $6,000 for 2021 or $7,000 if you were age 50 or older on or before December 31, 2021.

Important Reminders When Submitting Your Contributions:

- Make the check payable to Raymond James.

- Put the contribution year and account number on the memo line of the check.

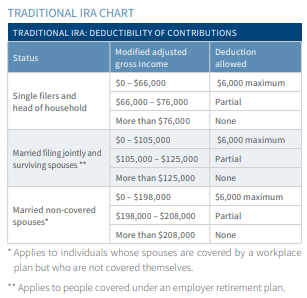

Traditional IRA:

- You can contribute to a traditional IRA for 2021 if you had taxable compensation. However, your ability to deduct your contributions may be limited or eliminated if you or your spouse were covered by an employer-sponsored retirement plan in 2021 depending on your filing status and modified adjusted gross income (MAGI). (See table below). If you are eligible to contribute to a Roth IRA, in most cases you’ll be better off making nondeductible contributions to a Roth instead of a traditional IRA.

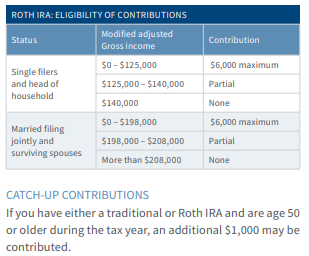

Roth IRA:

- You can contribute to a Roth IRA if your modified adjusted gross income (MAGI) is within certain limits. For 2021, if you file as single or head of household, you can make a full Roth contribution if your income is $125,000 or less. If your income is between $125,000 and $140,000 your maximum contribution is phased out and you can’t contribute at all if your income is $140,000 or more. If you are married and file a joint federal tax return, you can make a full Roth contribution if your income is $198,000 or less. Your contribution is phased out if your income is between $198,000 and $208,000. You can’t contribute at all if your income is $208,000 or more.

Making a last-minute contribution to an IRA may help you reduce your 2021 tax bill. If you qualify, your traditional IRA contribution may be tax deductible. For more information, visit irs.gov.