Granting Guidelines for Donor Advised Funds

Understand how donor advised funds can – and cannot – be used to support the charitable causes important to you.

Donor advised funds (DAFs) are a powerful and efficient tool for individuals looking to make a meaningful impact with their philanthropy. However, it’s essential to understand the guidelines and regulations governing DAFs to ensure that grants are used appropriately and effectively.

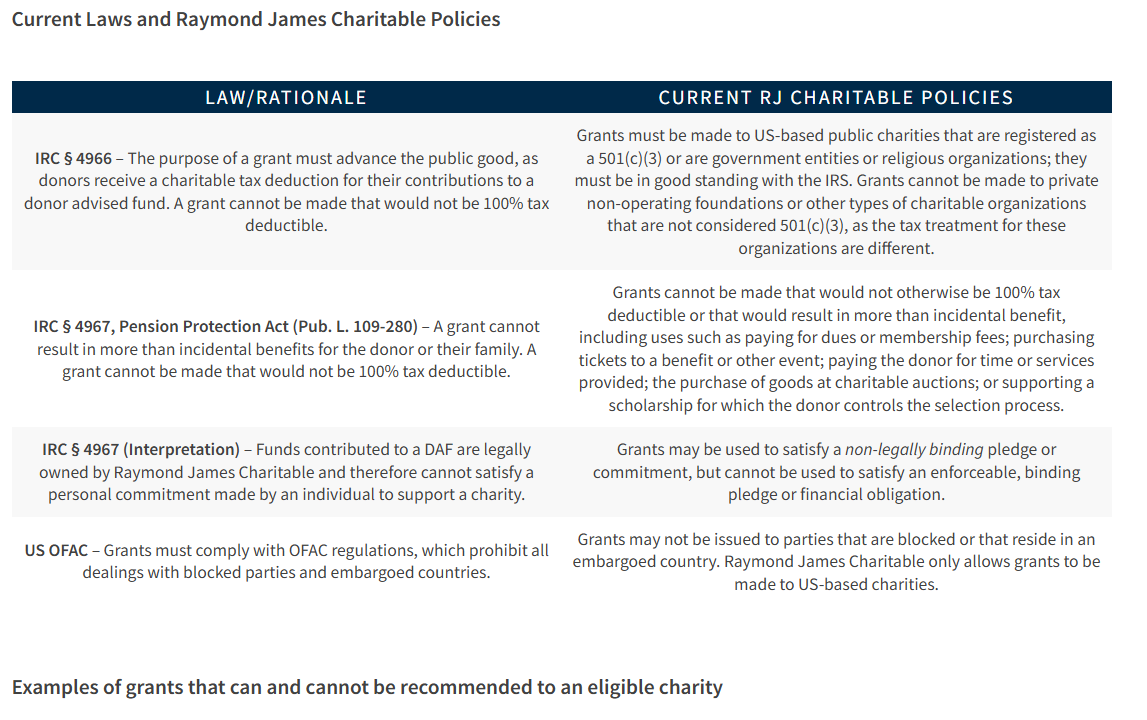

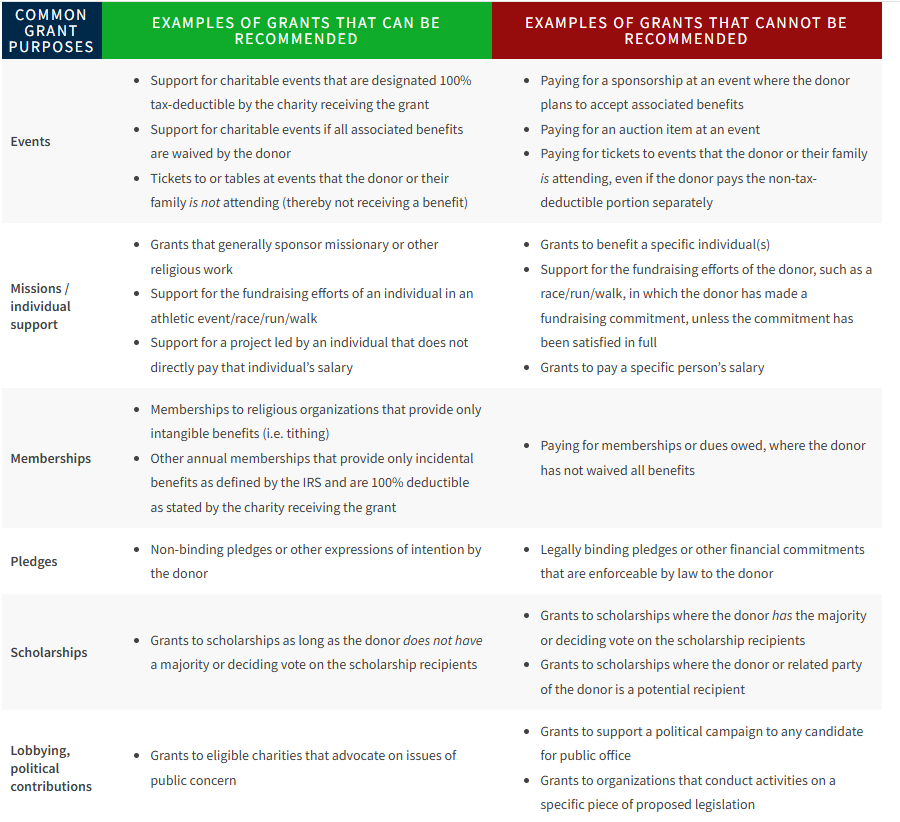

DAFs are accounts within a tax-exempt 501(c)(3) public charity, making them subject to IRS regulations under the Pension Protection Act, the Internal Revenue Code(IRC), and the US Office of Foreign Assets Control (OFAC). DAF programs may also implement their own policies to ensure ethical and effective grantmaking. Federal penalty excise taxes can be imposed for improper use of DAFs, affecting the sponsoring DAF organization, donors and financial advisors.

Familiarizing yourself with the guidelines for granting from a DAF is crucial for ensuring that your charitable contributions are used in compliance with regulations.

To learn more about the current DAF guidelines, we encourage you to review the IRS guide on donor advised funds.