5 Ways to Get the Power of Dividends to Work for You

Everyone likes to get paid. Did you know that you can get paid as an investor, too? How? Through the power of dividends.

When a company earns a profit, there are two main places where the money can go:

The profits can be put back into the company to expand operations (by purchasing additional equipment) or to pay down their debt.

Profits can be distributed as a dividend, which is a cash payment to shareholders.1 When profits are distributed as a dividend, they offer an investor the opportunity for a source of income, the potential for growth, and a way to reduce portfolio volatility, among others.

Let’s look closely at 5 ways to get the power of dividends to work for you.

Why Are Dividends So Powerful?

1: Source of Income

The first thing that comes to mind for shareholders receiving dividends is the cash payment — your share of the profit. That payment is a source of cash, and you can take the dividend as income, rather than withdrawing income from the account principal. Most dividend-paying companies do so either quarterly or annually. For retirees, receiving cash dividends as income can help keep their retirement account together, as long as the dividends are greater than withdrawals.2

2: Reinvesting Dividends

When you reinvest dividends, the dividend payment is used to buy more shares of the stock that paid the dividend. This approach has two potential advantages for the investor:

a: You can increase the number of shares you own.

b: You have an opportunity to increase your wealth over time through compound growth.

First, let’s look at the benefit of compound interest (or compound growth). The two main ways to calculate interest are simple and compound. Simple interest pays on the value of the investment only. Whereas compound interest calculates growth on the value of the investment plus the amount of growth from previous periods, or “interest on interest”.

When dividends are reinvested and compounded, the growth from previous periods can make a significant difference in the value of an investment. Look what compounding can do over 7 years in the example below.1 Legend has it that Albert Einstein was so impressed with the effect of compound interest, that he crowned it the “8th wonder of the world.”

Source: https://www.visualcapitalist.com/power-dividend-investing/ This is a hypothetical example for illustration purposes only and does not represent an actual investment.

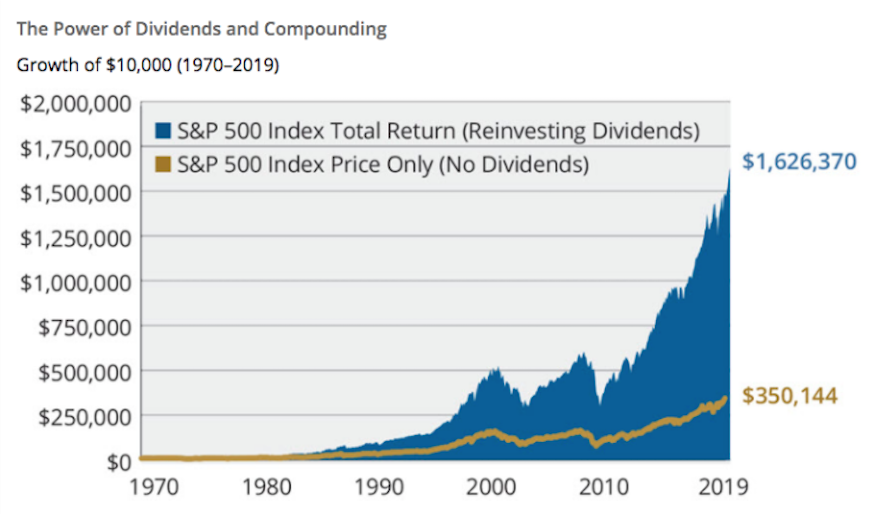

Now, let’s look at an example of how reinvested dividends and compound interest work together in the graph below. With dividends reinvested, the compound growth of $10,000 is $1,626,370 since it includes dividends reinvested over the previous periods. If the dividends were withdrawn in cash, the principal would have grown to only $350,144 over the same time period.3

Data Sources: Morningstar and Hartford Funds, 2/20.

Past performance does not guarantee future results. For illustrative purposes only. Dividend-paying stocks are not guaranteed to outperform non-dividend-paying stocks in a declining, flat, or rising market. The graph is not representative of any Hartford Fund’s performance, and does not take into account fees and charges associated with actual investments. Indices are not available for direct investment.

Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

3: Increase in Dividend Payments

For many investors, dividends from good companies are attractive because they can be predictable and sustainable. Some companies have been paying dividends uninterrupted for decades. There’s more good news: dividend payments can be increased by the companies that pay them. Take consumer giant Proctor and Gamble, for example, which has increased its dividend for 63 consecutive years.4 Companies that consistently raise their dividends have historically exhibited strong fundamentals and solid financial health.

4: Hedge Against Inflation

Goods and services cost more during periods of inflation when prices rise the power of your dollar is eroded. Dividends can provide a hedge against rising prices. Since 1912, dividends have increased by 4.2%, outshining the 3.3% rise in the inflation rate in the same period.1

5: Reduce Volatility

Did you know that one of the attractive qualities of dividends is that they can cushion swings in stock prices? Dividend-paying companies often have less volatile returns, because they generally are more stable than their non-dividend paying counterparts.4 After all, companies that pay dividends are returning profits earned to their shareholders.

Get the Power of Dividends to Work for You

“We believe in owning good quality companies that “pay us” while we hold them,” said Savannah Holley, Wealth Strategist Specialist for Gratz Park Private Wealth. “History shows, over time that stock prices have moved in line with the earnings of their underlying companies. If companies can increase dividends as their earnings increase, then over time, stock prices should follow and provide attractive total returns.”5

“We believe in owning good quality companies that “pay us” while we hold them,” said Savannah Holley, Wealth Strategist Specialist for Gratz Park Private Wealth. “History shows, over time that stock prices have moved in line with the earnings of their underlying companies. If companies can increase dividends as their earnings increase, then over time, stock prices should follow and provide attractive total returns.”5

Want to know more about the power of dividends? We recommend reading the “Strategic Dividend Investor” by Daniel Peris. As always, please reach out to our team with any questions you may have. And, thank you for your trust in us.